Banking Foundations Certificate Program

We built this program after watching too many people struggle with basic banking concepts. Eight months of practical learning starting September 2025, designed around real scenarios you'll actually face.

Request Program Details

How We Actually Teach This Stuff

Look, most banking courses throw theory at you and hope something sticks. We don't do that. Our approach came from three years of trial and error with over 200 students.

Every module starts with a real situation—like figuring out mortgage payments or understanding why your credit score dropped. Then we break down the banking side of things. The goal isn't memorizing formulas. It's knowing what to do when life throws you a curveball.

- Weekly case studies based on actual client scenarios from Canadian banks

- Small group discussions where you can ask the questions you're actually wondering about

- Progressive assessment that builds on previous modules instead of cramming for exams

- Access to industry tools banks use, not simplified student versions

What You'll Learn Over Eight Months

We structured this to build your skills gradually. Each phase prepares you for the next one, and nothing feels rushed or overwhelming.

Banking System Foundations

First two months focus on how banks actually work. Not the textbook version—the real mechanics of deposits, withdrawals, accounts, and regulations that matter in Canada.

Credit and Lending Fundamentals

Months three and four get into credit scoring, loan applications, and risk assessment. This is where things get interesting because you start seeing how banks make decisions about who gets approved.

Investment and Savings Strategies

Months five and six cover investment products, savings plans, and retirement accounts. We keep it practical—what works for real people with real budgets, not theoretical portfolios.

Specialized Services and Integration

Final two months bring everything together. You'll work on complex scenarios that combine multiple banking services, just like you'd encounter in an actual banking role.

Who's Teaching This Program

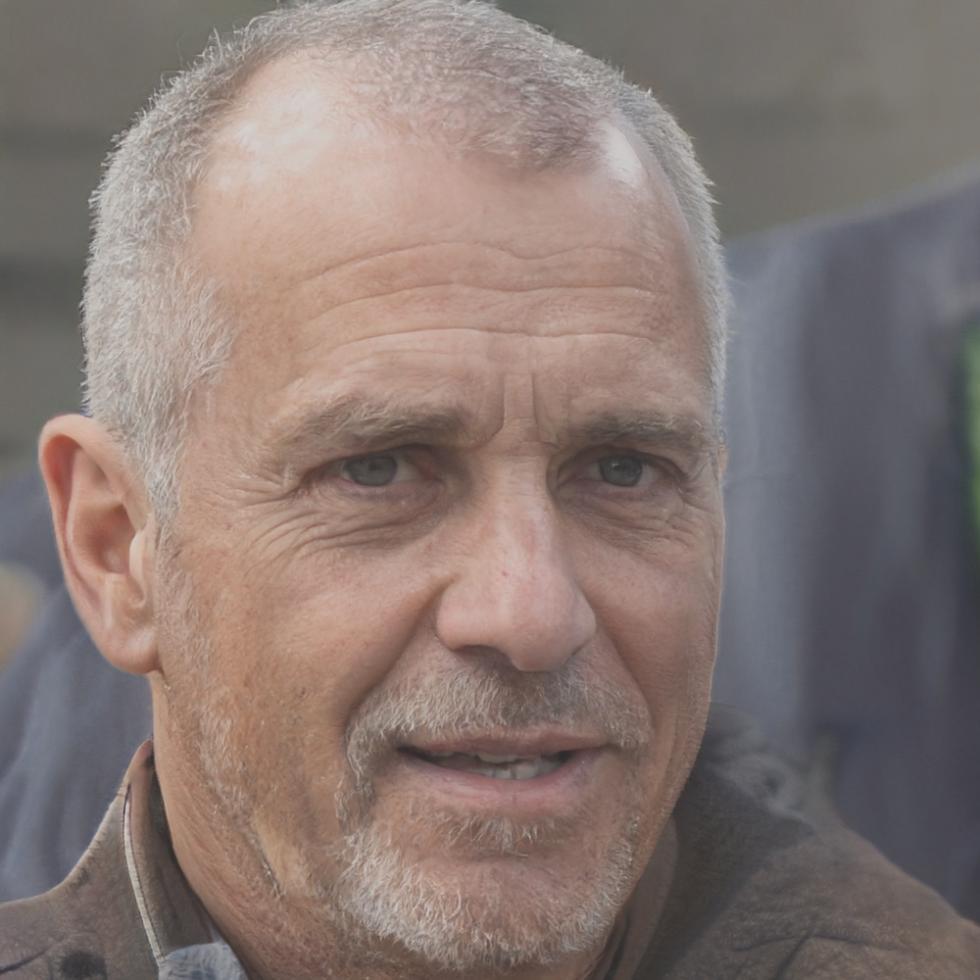

Huxley Fenwick

Credit Services Instructor

Spent fourteen years processing loans at three major banks. Teaches the credit modules because he's seen every mistake people make with applications.

Quinby Aldridge

Investment Services Lead

Former investment advisor who realized she preferred teaching to sales. Handles all the investment and retirement planning modules with refreshing honesty.

Draven Pembroke

Banking Operations Specialist

Manages the foundation modules. Previously ran branch operations and knows exactly what new banking professionals struggle with most.

September 2025 Enrollment Opens May 1st

We cap each cohort at 24 students because that's what works best for the group discussions and hands-on work. The program starts September 8, 2025 and runs through early May 2026. Classes meet Tuesday and Thursday evenings, plus some Saturday workshops.

Get Application Information